First, let’s start with a bit of background.

I have been a part of Horizon State since the beginning — all starting with a few beers with Jamie Skella chatting about how powerful the concept of smart contracts were, and after a few trips to Melbourne to set things up we had the crew required to launch our ICO. From first team formation to ICO in only a few months. In reality, this had been brewing for a while.

At the time, this was all quite new and exciting. The tech was amazing and the concept for the project was solid. It was the second half of 2017 — the heyday for the crypto ICO market.

The next few months were some of the most stressful we have all ever experienced in our careers. We learnt that if we had our time again, we would have carved out more preparation time; built a solid community, got the word out and constructed the foundations needed to ensure success. In the end, we did the best with the constraints we had — a short amount of time, little to no money for marketing or promotion, but a great idea with a passionate team.

Now, a little on hindsight and the issues that come with the concept of “code is law”:

- Once that smart contract is coded, audited and deployed and the ICO has started, that’s it. No more changes. You really need to ensure you have gone through every possible scenario first and brainstormed how the smart contract should handle it.

- The end date for the ICO was locked in once the process started. We would have loved to extend it but alas, it was not possible.

- Because we raced to ICO and didn’t have a marketing budget, we had a small raise (just over $1m at the time).

- Our contract was set to “mint on demand”. We had always said that the public sale was to be 60% of tokens and the company/team/advisors/bounties would constitute 40%. The error we made was this; the first act of the contract going live was to instantly mint those 40% of tokens, with the other 60% sitting as potential. Once that sale was started, there was no changing it and no stopping it, so in the end we held more than 90% of all tokens — obviously not what we wanted.

The final weekend of the ICO, we got together and decided that we would stick to the original plan of a 60/40 split. This meant we needed to somehow “kill” a whole lot of tokens… another hindsight moment, as we had no way of handling this in the contract. What we decided to was create a purgatory contract, with no ETH. Now, this gets a little technical, but essentially it means that any tokens sent to this address would be locked as there is no way to send ETH to it (and a small amount of ETH is needed to pay the gas to move tokens out of any address). End result — any tokens sent to this address would be locked forever. There are currently more than 362 million HST there, and counting.

With the token event over, it was time to let the world know how we saw our token economics working. Given that we are a B2B company, and most of the institutions that we were going to engage with were not “crypto native”, we needed to find a way to enable them to participate in this new token world with as little friction as possible.

Enter the Horizon state token mechanics. Feel free to read up for a deeper dive, but essentially we needed to explain how the average business or government would be able to pay for our services in FIAT ($), but still ensure that our token is used to pay for services in our ecosystem. As a part of this, we also wanted to use the token to live up to our company ethos, by giving a percentage of all HST tokens that went through the system to charitable causes and infrastructure. This is all possible with our token mechanics, so it’s worth a read (credit to Nimo Naamani on that one!).

Our next task was to get our token listed on the relevant industry websites. We wanted to ensure that we were represented in all the most common tools used by people to read about the crypto space, price check, etc. We reached out to so many websites, with a marketplace that was still finding its feet — so changing constantly.

Out key targets here were:

- CoinMarketCap (CMC) — the largest of the pack and essentially the whitepages of cryptocurrencies, blockchains, tokens, etc. At the time we needed a daily volume of more than $100k USD to be considered (more on this later).

- Etherscan — which is a blockchain explorer for Ethereum. Given the HST token is an Ethereum ERC20 token, this was critical.

- CoinGecko — a site that tries to collate both pricing data and news, ICO specifics, etc.

- Blockfolio — the #1 price checking and portfolio tracker. It has since grown into a great place for companies to inform their supporters of relevant news.

While all this was going on, a curious thing was happening. It turned out that all the work that Jamie Skella had done touring the world and drumming up interest in our project had started to kick in — AFTER the token sale had finished. This left us in the curious position where demand for the token was high, but availability was difficult. After all, we hadn’t listed on any exchanges at that stage.

Enter EtherDelta! One of the great things about the Ethereum chain is that it is supported quite well by an array of Decentralised Exchanges (DEX). I’ll be doing up another article about these in the future. They are smart contract powered websites, normally using MetaMask or a similar Web3 tool, to enable you to directly interact with the chain and its contracts.

As EtherDelta was the only real place people could buy HST, and the demand was so high, we raced up their volume charts to be in the top 5. The resulting price discovery (supply and demand) then pushed up the token sale price.

It was at this time that we made first contact with an exchange. KuCoin contacted me via Telegram and said that they noticed the high demand for our token and wanted to fast-track us onto their exchange. Interestingly, they said that they were worried that Binance was also keen on listing us, and wanted to get in first (fine by me, but unfortunately not what happened!).

A few days later, and in a nice change — at no cost to us — we were listed on KuCoin, an exchange that would remain our main source of liquidity for the next year.

What came next was nuts.

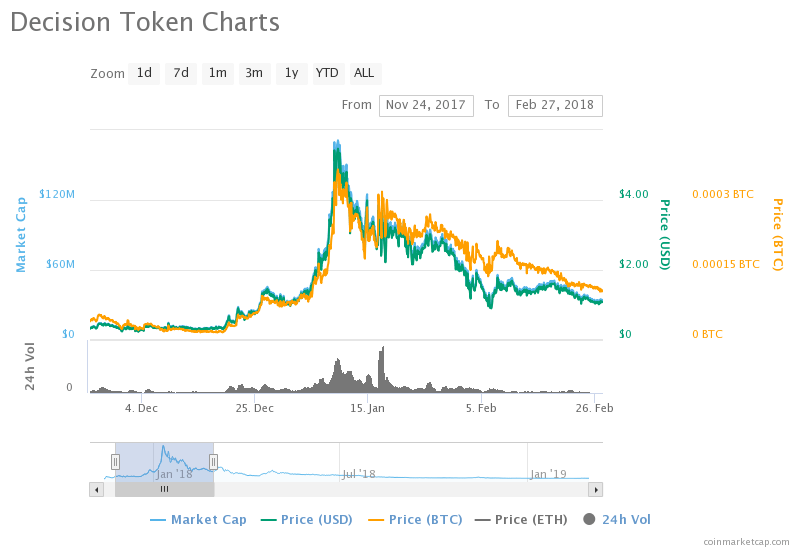

The end of 2017 bull run was a sight to behold. HST went from 0.035c USD mid December, to $5.47 USD Jan 9. We were surfing the wave up with Bitcoin and Ethereum, and nothing seemed real. After that, reality caught up and we ended the bull run — and started the bear market of 2018.

In 2018, we settled into a bit of a rhythm, with the development team busy building, and Jamie Skella touring with Alex Saunders and Trader Cobb. My focus was establishing a listing roadmap to ensure HST had a path forward to multiple exchanges worldwide — providing coverage to key markets and ensuring a stable token environment.

My work started paying dividends, and we were well progressed down the path of listing on a prominent Asian region exchange, when China decided to step in and sprinkle some FUD on the market.

- January 2018: The Chinese government imposes regulation banning P2P sales and over-the-counter markets

- February 2018: The Chinese government blocks access to foreign crypto exchanges and ICO websites

Given the uncertainty of the situation, and China’s penchant to do whatever they want, exchanges in the region started to retreat into their shells — not listing new tokens and focusing inward to ensure survival. This meant our much discussed listing was killed off, and we were back to the drawing board.

With the bear market continuing to bite I didn’t have the luxury of “throwing money at the problem”, and had to get creative with our next listing attempt. What I looked for was an exchange with integrity, a strict oversight and a tough legal review process. My rationale was, given what we were trying to do (blockchain voting) and given our ethos of ensuring transparent governance, I wanted to make sure that we were working with a like minded institution.

Bittrex US was the target exchange.

In the background of this process, I had to deal with an eager community who wanted to know what was happening with new exchange listings — but whom I couldn’t give any details to! There is only so long that “Sorry, we can’t talk specifics but we are continuing to actively work on this” will go before people get upset. I understood their sentiment completely and, rest assured, it was one of the most frustrating experiences for me to go through not being able to communicate anything and reassure people.

We were told that if anyone outside of myself and the founding team found out, the listing would be cancelled — and it had happened before. I couldn’t even talk to most of the staff about it. It proved to be one of the most frustrating aspects of the journey.

Not only that, the exchange listing scene (given the amount of money involved, and the fact that the regulations haven’t yet caught up) is, to quote an Australian idiom, “a bit dodgy”.

Half of the offers I’d have sent to me would be outright scams. All the way from broken English Telegram chats that are quite obvious, through to spoofed emails and fake LinkedIn profiles. It’s a minefield. You need more than a passing knowledge in IT to be able to sift through and counter the attempts and work out what may be a legitimate request.

Those that turn out to be legit are 95% of the time selling a fallacy. “Top 10 on CMC!”, “1.5 million users!”, etc. When you dive into it, you see that tokens that pay the listing fees get listed on an exchange that really doesn’t care about them post fee payment. Their figures both volume and customer wise are quickly established as false, and they sit with little volume doing nothing after launch.

Much of my work is therefore research related. Digging into claims, and either verifying or, more often than not, discounting them. Or, as sometimes happens, dealing with the same exchange over and over as, after already rejecting an offer from an exchange, a different commission-incentivised sales rep hits you up from the same place and tries for the 7th time. This is an ongoing part of my gig now…

With the SEC having just come down hard on the project “The DAO”, exchanges worldwide were requiring projects to have legal reviews done certifying their tokens as “Utility tokens” to ensure they protected themselves from any legal ramifications.

As we were attempting to list on a US exchange, they were understandably far more stringent on applying that distinction; and thus began the lengthy review and audit process of Horizon State the business and all its public facing material (website, documents, all social media, etc — since day 1 of the project). To get an idea on the extent of the review — we were asked questions about a staff member’s personal Reddit account and an individual comment they made. It was thorough, and it lasted months and months.

The process ended with an independent review by a US legal firm experienced with SEC law writing up their analysis , and finally giving us the verdict that they were comfortable categorising HST as a utility token.

Whilst this was tough work, it did give us the grounding going forward that we’d done the hard yards in this respect, and put us on a solid footing moving forward.

Only after this was completed were we able to start the final process with Bittrex, and once again, we made solid progress until things stalled. It turns out that at this time behind the scenes, Bittrex had been working on expansion plans and this meant working with the crypto-friendly jurisdiction of Malta to form Bittrex International. After this was established, future listings were planned to be funnelled through the new international entity, and only after that happens would they consider listing the tokens with their other exchanges (Bittrex US, for example).

So, we started the process again! This time with Bittrex International — and this time thankfully with a head start in the process. As a part of the listing rules, we are not told when the actual listing will happen. We would just wake up one day listed. This meant that for about a month, every possible listing day I was up at 4am busy checking Bittrex International and Richie on twitter — waiting to see if today was going to be our day.

At 5:03 AM on the 22nd Feb 2019 — it happened. Happiness, relief, vindication. It was a good day.

Behind the scenes, we had an amazing team that had not only kept building this whole time, but had completed version 1 of our product, signed customers and was just focused on being a good startup. Coding, signing customers and running live blockchain voting. Without this happening, all my work would be for nothing.

So, where to from here? The rise of DEX’s? More consolidation in the exchange space? Clearer regulations in key jurisdictions, providing the certainty required for the wider business community to get involved? It’s going to be an interesting 2019.

The lessons learnt and contacts made during this journey have been immense. I have a far greater understanding of the crypto and token landscape now than I did before this, and this will help going forward.

This is not the end of the token’s journey. I’m not in “maintenance mode”. This landscape changes quickly, and we need to ensure we have a plan for any contingency. I’ll continue my work to ensure a healthy working environment for the HST token, and I’m keen to see how the marketplace matures in 2019 and 2020.